Trading currencies in normal market conditions typically involves taking calculated risks, but trading them during major news events can be far riskier. For this reason, many conservative forex traders choose to square their positions during the time frame immediately before and after the release of important economic data or other schedule news announcement.

With that noted, some forex traders use strategies that thrive on the dramatic volatility often seen surrounding news releases. They typically watch the market closely during these events, try to react quickly, and maintain strict trading discipline in order to open and close currency positions optimally during such risky events.

The following sections of this article will introduce key concepts relevant to forex news trading and will mention some popular trading strategies employed to take advantage of significant market movements that can occur around scheduled economic news reports.

Forex News Trading : Understanding Market Consensus

One of the most important concepts to understand when contemplating trading around foreign exchange market news releases is that of the market consensus. Simply put, this is the average expectation of financial analysts and market participants for a particular economic report.

Some market moving events, such as major natural disasters and political assassinations for example, can certainly come as a surprise to the majority of market participants. Nevertheless, the timing and even the approximate outcome of most newsworthy market events can be anticipated in advance with reasonable accuracy in many instances by those skilled in economic forecasting and by professional polling organizations.

Individual currency market analysts might use financial models, their personal research, consumer confidence reports and other prudent means at their disposal to come to an expert opinion about the likely result for a major economic data release. As many analysts express their views, a market consensus eventually forms that becomes the standard against which the actual result will be measured.

If the observed result is better than what the consensus was expecting, the market may react favorably. On the other than, if the result turns out to be worse than the consensus, then the market will be disappointed and will likely react unfavorably. A result in line with the consensus will typically have a relatively muted market impact.

“Buy the Rumor, Sell the News” Explained

Perhaps one of the trading maxims most often shared by experienced traders to those they mentor is the advice to “Buy on the rumor, sell on the news”, with the latter part sometimes being alternatively phrased as “sell on the fact”.

While this saying probably originally pertained to the stock market and therefore seems biased towards those contemplating taking long positions, its wisdom can be readily applied to other financial markets, including the forex market. Of course, one has to understand that there may also be a good time to “sell on the rumor, buy on the news” when it comes to trading currency pairs in which both long and short positions can be taken with equal ease.

In any case, the essence of this sound advice is based on the observation that markets often move in advance of an important news event or economic data release due to rumors and analytical projections about what the result will be. Traders at large financial institutions and fund management firms often take positions based on those sources of information, and they frequently talk to each other about what they or their favorite economist are expecting.

Once the data is released, traders and market makers will immediately compare it with the market consensus and revalue the exchange rate depending on whether the result was favorable or disappointing. On top of that consensus versus result effect, a position squaring effect also emerges as those large market players who took positions ahead of the news event on rumors or analysis subsequently close them out once the actual result becomes a known fact. This position squaring effect can result in significant counter-intuitive moves after a data release is announced.

For example, a fund manager may have heard a rumor that the Federal Open Market Committee or FOMC that sets benchmark interest rates in the United States is strongly considering raising rates if the Non-Farm Payrolls number for that month turns out to be as strong most economists expecting.

He may therefore take a long U.S. Dollar position versus the Euro in advance of when the Non-Farm Payrolls data is due to be released anticipating a fall in the EUR/USD exchange rate on a strong number due to increased expectations of a rise in the Fed Funds interest rate set by the FOMC. Then, when the data does come out more favorable than the consensus as he expected, he will take any subsequent decline in the rate as an opportunity to square his position quickly since he would probably already be satisfied with his trading gains.

If enough large players trading on such rumors do the same thing, then the market can see a counter-intuitive move where the EUR/USD exchange rate initially moves down in the expected manner, but then snaps back upwards as profit taking sets in — perhaps rising even further than where it started when the data was initially released.

When to Hold, Reduce, Shift and Close Positions Over a News Release

Although trading during and around important news events can be an important part of the strategy of a trader that bases their trading decisions on fundamental analysis, many technical analysis based traders will go out of their way to square their trading positions ahead of such events.

Avoiding the excessive volatility associated with news releases may seem quite prudent to them, but their main rationale for doing so is typically centered on one of the most basic tenets of technical analysis — that “price discounts all” — and its questionable accuracy during economic news releases.

Technical traders might take view that if the information has not yet been released to the public, it cannot have been fully discounted yet upon its release and so that foundational technical analysis principle breaks down temporarily. Once the market shifts to discount — which means to price in — the new information after its formal release, technical analysis techniques can once again be applied with greater confidence and better results.

Even fundamental traders may not have the stomach or deep enough pockets to weather the forex market’s often outrageous movements sometimes seen around major data releases and other news events. The prevalence of very wide dealing spreads and much greater than normal order slippage at such times can make even the most stolid trader wary of holding or taking positions in such trading conditions.

Also, due to the high risk of substantial market volatility around important news releases, many traders willing to hold positions over news releases will often opt to reduce their position sizes at the very least. This prudent response to greater risk is a component of a money management strategy that can be incorporated into a forex trading plan.

Furthermore, the price and implied volatility of options which incorporates such risk events generally rises, since the probability of further out of the money options ending up in the money increases. Many traders would rather hold options that have a limited downside potential over a major news release than risk the significant slippage that can be seen on a stop loss order in highly volatile fast markets where exchange rates are fluctuating widely and moving quickly.

Currency News Trading Tools

Perhaps one of the most important tools of the FX news trader is a good forex news calendar for any currencies they intend to take positions in. Most online forex brokers compile and publish such a calendar, in addition to numerous independent forex related websites.

A suitable economic calendar will typically list all of the relevant events coming up on each trading day for each currency, their priorities in terms of their potential market impact, their release times, the market consensus, and what the previous result was. Once the data is released, that should also show up quickly on the calendar.

Another key tool for the currency news trader will be having real time access to a reputable financial news wire that quickly publishes news relevant to the currency market and the results of all major economic data releases. When it comes to making trading decisions based on news events, the more timely the news, typically the better your results will be.

Key Forex Currency News Events

The most sensitive releases that affect currency rates and are the most traded by forex traders include the following:

Benchmark Interest Rate Decisions – Generally, central bank rate decisions cause the most volatility in currency pairs, especially when an interest rate hike or cut was unexpected.

Inflation Data – The level of the price of goods in a nation and whether prices are increasing or staying in a range can significantly affect central bank monetary policy.

Key Jobs Data – Unemployment rates and the amount of people receiving benefits for unemployment provides a barometer for a nation’s economic health. U.S. Non-Farm Payrolls data is one of the most closely watched economic indicators of this type and can have a substantial market impact.

Preliminary GDP Data – A country’s gross domestic product is one of the most important measures of an economy’s health.

Trade Balance and Current Account Data – Variations in the balance between a country’s imports and exports has a substantial impact on a currency.

National Elections – A nation’s political climate has an important effect on the country’s currency, especially if a major economic change will take place when a party gets elected.

Relevant Referendum Votes – Public votes on important national matters, such as staying or leaving an economic bloc for example, can significantly affect the value of that country’s currency.

News Impact on the Forex Market – Non Farm Payrolls Example

One of the economic data releases that has become notorious for inducing large exchange rate movements in currency pairs that involve the U.S. Dollar is the U.S. Non-Farm Payrolls data, which is typically released on the first Friday of each month. Many news traders consider this one of their best opportunities to trade on the substantial volatility in the forex market that can occur immediately after a news release.

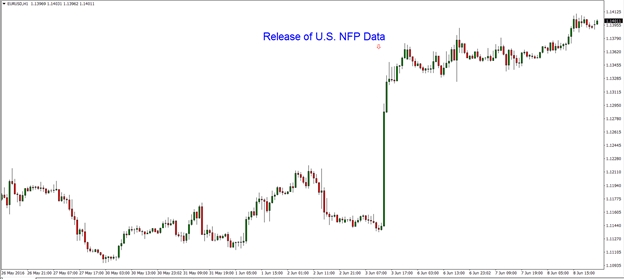

As a concrete example of the strong impact that an important economic number that differs substantially from the market consensus can have, consider the case of the Non-Farm Payrolls release that occurred on June 3rd of 2016.

On that release date, the forex market was expecting a rather upbeat 159K number consistent with a fairly buoyant U.S. economy, but the actual rather dismal result was the addition of only 38K jobs, and the previous 160K result was revised down to 123K.

As the exchange rate chart for EUR/USD depicted in Figure 1 shows, this disappointing release caused a rapid and substantial depreciation of over two big figures in the U.S. Dollar versus the Euro shortly after its announcement on financial news wires. The Dollar also fell significantly against the other major currencies at the same time.

Figure 1: A sharp upward spike in EUR/USD that was observed on the one hour chart immediately after disappointing U.S. Non-Farm Payrolls data was released on June 3rd, 2016.

Currency News Trading Strategy Ideas

Trading the news in forex needs to be done strategically due to the need for fast reactions in the volatile market conditions surrounding the release of major news. Numerous creative ways have been devised by traders to take advantage of the extreme volatility often seen if the actual result deviates from what is expected by a consensus of market participants.

While such large and sharp price swings can result in substantial and quick profits, they can also mean large losses can accrue quickly, so be sure to use prudent position sizing depending on your personal risk tolerance if you intend to trade on news releases.

A number of strategies can be employed to take advantage of exaggerated market moves after significant releases. Some of the more popular strategies which have proven to work consistently are listed below. Remember, although they may seem tempting, news trading can be risky, capital intensive, very stressful and so is not for everyone.

Hedged Position Trading

A hedged position is one that has reduced or no theoretical market risk associated with it. Although not available to all traders due to legal restrictions in some jurisdictions, such as the United States, some forex news traders might use a hedged position over a news release in which they simultaneously take both a long and a short position in a currency pair that might be affected by the release.

The hedge trader typically plans to take a profit on one leg of the hedged position when the market swings in its favor. They then can take a reduced loss or even a profit on the other leg when the market swings back.

This sort of news trading strategy takes advantage of the common knee-jerk reaction in response to a data release followed by the profit taking that typically occurs as those who traded ahead of the release begin to close their positions.

Pre-Release Trading Range Breakouts (aka Straddle Trading)

This strategy involves the trader identify currency pairs which are range trading ahead of a major release. When the news item comes out, the trader watches for a break out of the range and takes a position in the direction of the breakout once it has been established.

A trader using this strategy will typically place stop losses within or near the base of the former trading range and set a take profit objective roughly equal to the width of the pre-release trading range.

Non-Directional Pre-News Trading With Options

Buying straddles and strangles involves buying both call and put options in the same currency pair for the same expiration date and can be an appropriate strategy if the trader is fairly neutral on the post-release direction of the market. These option strategies, when structured properly, can also pay off well if a substantial market movement is seen after a news release.

Directional Pre-News Trading With Options

When a trader wishes to position themselves in a particular direction ahead of the news release with limited risk, they can purchase either an up or down binary option or a vanilla call or put option.

Placing Small Orders

Some online forex brokers will automatically execute small orders for their retail customers at the trader’s price despite fast market trading conditions that can occur after significant news releases. This allows for the news trader to place both a sell order below the market and a buy order above the market in a range around the pre-release market level.

If one of these orders is executed after the news release, the other order is cancelled and the trader can exit their trade for a profit if the market continues in the original post-release direction.

Furthermore, post-release directional market movements can sometimes be very strong, so an order may be executed at the level entered when the market is actually trading significantly beyond that. This means the trader may be able to take profits just after execution by closing out their position quickly before a retracement occurs.

Many traders are attracted to news trading due to the increased volatility around these events. We have outlined some of the more common news trading strategies that can be employed by both fundamental and technical traders. But always keep in mind that increased volatility in the market also increases the level of risk, and so traders are reminded to use strict money management controls if they decide to trade around news events.