If it were up to borrowers, it’d be easy to get a loan with no money down. Unfortunately, that isn’t the way it works.

Lenders want to lower their risk and often require some type of down payment. But if you don’t have tens of thousands in the bank to cover the initial cost of securing a loan, you still have options. We’ll show you everything you need to know about obtaining different types of small business loans with no money down.

5 Best Small Business Loans With No Down Payment

Wondering “Do business loans require a down payment?” The answer is some don’t. Although it can be challenging and you may not get the best interest rate, no-money-down business loans are available. Learning about each loan type can help you determine the best fit for your situation.

1. Term Loans

Business term loans are one of the most common funding solutions for small businesses. They allow you to borrow large amounts of capital and repay them over years.

One of the benefits of term loans is that you don’t always have to put money down to get one. If your lender looks over your credit and application and deems you a fit, they may only ask that you put up collateral or sign a personal guarantee.

If you’re using the funding to buy commercial real estate or equipment, they might even use that asset as collateral.

Interest rates for these financing products are generally lower than other options and are typically reserved for more qualified borrowers.

2. Equipment Financing

If you need funding to buy or replace equipment for your business, you may not need to put money down as equipment financing could cover up to 100% of the cost, in some cases. However, if the equipment will rapidly depreciate, many lenders will not fund the full 100%, leaving you to come up with a down payment.

What’s more, because equipment financing is self-collateralizing, it’s one of the easier types of financing to qualify for. So if you’re a new business or haven’t yet established good business credit, equipment financing may be your best bet to get a first-time business loan with no money down.

3. Invoice Financing

Unlike other types of loans that use fixed assets for collateral, invoice financing — a type of accounts receivable financing — doesn’t require a down payment. You essentially sell your unpaid invoices to the lender with invoice financing and the invoices are your collateral.

Invoice financing is a great option for companies in the business-to-business sector with long payment cycles.

4. Business Line of Credit

Although business lines of credit aren’t considered conventional business loans, they can be a great alternative if you don’t have collateral or money for a down payment.

Most lines of credit are revolving:

- Once you’re approved for a business line of credit, you’re given a pool of money that you can borrow against. When you need access to cash, you simply transfer it into your checking.

- After you draw money against your line of credit, you’ll have to start making payments to your lender to cover the interest charged on the money you’ve used. Anything extra that you pay each month goes toward your loan balance.

- As you pay back your line of credit over time, your pool of available funds builds back up, and you can draw funds again as needed. This process doesn’t require you to apply for a separate loan each time you access a line of credit.

5. SBA Microloans

If you’re looking for a startup business loan with no money down, consider an SBA microloan. These loans are for amounts up to $50,000. Of note, while the SBA does not require a down payment for these types of loans, SBA-approved lenders providing the microloan funding might.

And though you may not be required to offer a down payment, SBA microloans generally require collateral to secure the funding.

Providing a down payment on a small business loan gives a lender confidence.

The more you can put down, the better. Putting down more money upfront reduces the amount you have to pay back over time and typically results in lower rates and fees.

How Lenders Determine Down Payments

Obtaining a business loan with no money down can prove difficult because it doesn’t offer lenders as much protection on their investment. Even borrowers with the best credentials may be asked to contribute cash to secure financing.

How much of a down payment you need for a business loan will depend on a few factors:

Loan Type

Some types of small business and commercial loans require a certain percentage of the total loan amount to be included as money down.

For example, the Small Business Administration (SBA) requires SBA 504 loan applicants to offer a down payment of 10%-20%.

Principal Amount

The principal amount has a large effect on a commercial loan down payment. When lenders see big loan requests, they see big risks. Even though larger loans are generally only given to more qualified applicants, banks may still want an investment on your end to reduce their risk.

Term Length

Lenders know the longer borrowers take to repay a loan, the more time they have to default. Because of this risk, obtaining long-term small business loans with no down payment is very difficult, if not impossible.

Creditworthiness

It can be challenging to get any type of financing if you don’t have solid business and personal credit scores that show a history of being able to take on and pay your debts. Without this, applying for a significant business loan with no money down could be a nonstarter.

If you don’t have a credit history or certain factors have lowered your score, lenders will need money down to consider your application. To get better overall terms, try building up your business credit score.

Characteristics of a No-Money-Down Business Loan

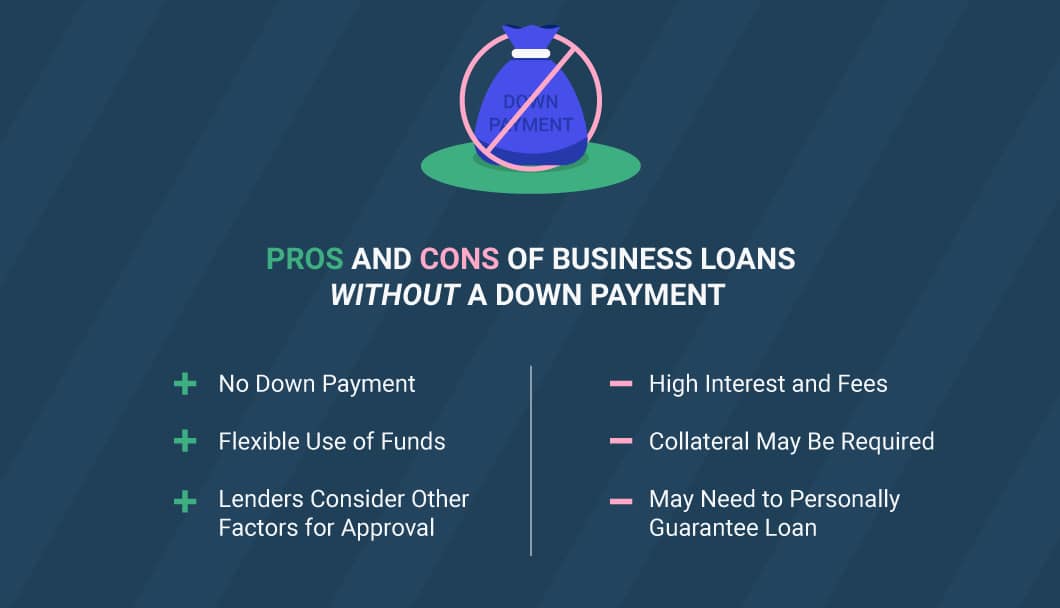

Loans that don’t require down payments sound like a borrower’s dream. However, the terms for these loans are consistent with those available to riskier borrowers. Not surprisingly, no-money-down business loans often have lower funding amounts than loans that require a deposit. Terms may also be shorter and interest rates are typically higher.

Additionally, lenders may offset their risk by requiring collateral. Using assets such as real estate or equipment as collateral allows lenders to satisfy their need to be repaid if you go into default.

In contrast, lenders who don’t require you to pledge specific collateral may instead require 1 or both of the following to offset their risk:

- Blanket lien: Allows a lender to place a claim on all assets to satisfy the debt.

- Personal guarantee: If the business can’t pay its debt, the person providing the guarantee can be held personally responsible.

-

Alternative to a No-Money-Down Business Loan

Though not a loan, a merchant cash advance is a form of financing that does not require a borrower to put money down to qualify, and it’s one of the fastest ways a business owner can access capital.

With this type of funding, an approved applicant is given a lump sum of money, which is lent against a business’s expected future sales. This short-term financing is often repaid through daily installments.

Apply for a cash advance with no money down.

How to Get a Business Loan With No Money Down

When you’re wondering how to get a commercial loan with no money down, the first step in applying is finding out what you need. Go over the different types of loans we’ve covered and assess why you need the funding.

For example, if you need to purchase new machinery, look into equipment financing. If you need money for working capital in between client payments, consider invoice financing or a merchant cash advance. If you’re trying to start a business or need money for operating capital, SBA microloans and business lines of credit are great options.

When you search for a no-deposit business loan, think about the collateral you can offer, and whatever you do, don’t worry about not having cash on hand. While it can be more challenging to get a business loan with no money down, it is still possible.